All videos of Rakuten Fintech Conference 2016 were posted!

Leaders of FinTech are leaders of the future.

Announcing FinTech 2.0.

Catch a glimpse of the conference 2015

ABOUT

The concept of fintech, which is a fusion of finance and technology, has rapidly taken hold in Japan since 2015.

The environment surrounding the finance industry is currently undergoing dramatic changes as a result of the spread of smart devices as well as technological innovation, such as the utilization of the cloud and big data. Furthermore, fintech is engulfing financial institutions and administrative organizations alike, and is set to usher in the creation of a next-generation of finance systems.

How will we respond to these changes, and how will they be incorporated into business?

At the Rakuten FinTech Conference 2016, we will bring fintech leaders from Japan and around the world to learn about the latest developments in the field and explore the future that fintech will bring to Japan and the world.

SPEAKERS

Keynote Speech

Takatoshi Ito

Professor, School of International and Public Affairs, Columbia University/Senior Professor, National Graduate Institute for Policy Studies (GRIPS)

Takatoshi Ito, Professor, School of International and Public Affairs, Columbia University, has taught extensively both in the United States and Japan since finishing his Ph.D. in economics at Harvard University in 1979. He taught at the University of Minnesota (1979-1988), Hitotsubashi University (1988-2002), and the University of Tokyo (2004-2014) before assuming his current position in 2015. He held visiting professor positions at Harvard University, Stanford University, and Columbia Business School, and University of Malaya. He has distinguished academic and research appointments such as President of the Japanese Economic Association in 2004; Fellow of the Econometric Society, since 1992; Research Associate at the National Bureau of Economic Research since 1985. Ito served as Senior Advisor in the Research Department at the International Monetary Fund and as Deputy Vice Minister for International Affairs at the Ministry of Finance of Japan, and a member of the Prime Minister’s Council on Economic and Fiscal Policy. He is an author of many books including The Japanese Economy; and more than 60 refereed journal papers. He frequently contributes op-ed columns to the Financial Times. He was awarded by the Government of Japan the National Medal with Purple Ribbon in June 2011 for his excellent academic achievement.

Panel Discussions

Eli Broverman

Betterment, President and Co-Founder

Eli Broverman is Co-Founder and President of Betterment. Eli co-founded Betterment with a vision that smarter technology will help people better plan for their financial needs and reach their goals. Through his work at Betterment, Eli aims to make personal finance one of the first fields to reach the age of automation. Eli oversees the company’s business operations, strategic initiatives, and legal matters. Eli is a frequent guest on CNBC, FOX, and Bloomberg TV, and regular speaker at leading industry events.

Prior to forming Betterment, Eli practiced law at the international law firm Proskauer Rose LLP, where he advised Fortune 500 companies and their senior management on securities, tax, and compensation matters. Mr. Broverman is a graduate of Brown University and New York University School of Law.

Nicolas Cary

Blockchain.info, Co-Founder

Nicolas Cary is a serial entrepreneur and lifelong technologist. He attributes much of his insight to his personal journeys around the world. He holds degrees in Business with an emphasis in Leadership Studies and International Political Economy. He has taught English and conducted poverty reduction assessments in rural India prior to spending the past decade growing start-ups. He is trilingual, and has a deep passion for positive digital disruption. He was a founding Partner at PipelineDeals where he focused on product development and management. In 2013 he Co-Founded Blockchain. More recently he Co-Founded YBUSA.org, the leading youth business accelerator.

Winner of the 2015 European Digital Leader award for his inspiring and innovative contribution to initiate progress in the digital world, Mr. Cary accumulated over 300K miles last year doing FinTech advocacy, keynoting conferences, and attending grass roots meet ups across the Europe and around the world. His media appearances include the NYT, NPR, WSJ, Financial Times, Wired, Forbes, Entrepreneur, CNN, CNBC, TechCrunch, CNET, World Economic Forum, Marketwatch and many more.

His company Blockchain is the world's leading Bitcoin software company. Blockchain has over 7.25 million users, they run the most widely trusted block explorer, and manage the most widely used developer platform in the Bitcoin eco-system. In 2014, Blockchain raised the largest first outside capital round in industry history announcing over $30.5 million closed from leading venture capital firms.

Walter Cruttenden

Acorns, Co-founder & Chairman

Walter Cruttenden is a financial markets innovator. He founded and served as CEO of Cruttenden Roth, now Roth Capital Partners. Walter also founded and served as CEO of E*Offering, the investment banking arm of E*TRADE. E*Offering became the number one provider of online IPO’s before its sale to Wit Capital and ultimately to Schwab. Walter co-founded Acorns and serves as its Executive Chairman.

Freddy Dominguez

ComparaGuru.com, Co-Founder

Freddy is the Co-Founder and Managing Director of ComparaGuru.com, the leading financial price comparison platform in Mexico.

Before joining, ComparaGuru.com, Freddy served as a consultant at Booz & Company where he delivered projects in over 10 countries specializing in Go-To-Market, Cost Reduction and Growth Strategies.

Freddy holds a bachelor’s degree in economics from Tecnologico de Monterrey in Mexico.

Benjamin Duranske

CCOBOX, Co-Founder, CEO

Benjamin Duranske is co-founder and CEO of CCOBOX, Inc. a silicon valley startup software company creating advanced anti-money laundering tools for fintech firms, banks, and other payment providers.

From 2010-2015, Ben served as Chief Compliance Officer of Facebook's financial services subsidiary responsible for payments in games on Facebook, peer-to-peer payments in Facebook Messenger, and other social-media payments applications. Prior to that, Mr. Duranske served as legal counsel at PayPal and in private practice. He received his J.D. from the University of California, Berkeley, in 2003.

Ben also founded and serves as Principal Consultant at PayCom Consulting, LLC, where he helps innovative companies navigate payments regulatory issues while building great products.

Ben lives in Menlo Park, California with his wife and two daughters where, during down time, he enjoys hiking, writing fiction, and obsessively playing video games.

Alain Falys

Yoyo Wallet, Co-Founder and CEO

Alain is the co-founder & CEO of Yoyo Wallet, the mobile payment and loyalty app that helps retailers and brands better engage consumers, sell more and future proof their business in a mobile-first world. Yoyo Wallet has offices in London, New-York and Singapore and is the fastest growing mobile wallet in Europe.

Previously, he co-founded OB10, the global e-invoicing network which floated in London in 2013. He is a Partner at Firestartr, the technology investment platform that helps post incubator startups cross the chasm to series A and beyond. Alain was Senior Vice President at Visa International from 1996 to 2000, in charge of the Commercial Card division for Europe.

Alain is a Venture Partner at Imperial Innovations Plc and a Director at ACE Software and OneLinq. He lives in London with his family, where he also enjoys cycling, boxing and the art scene.

Scott Galit

Payoneer, CEO

Scott Galit is the CEO and a Director of Payoneer Inc. As Global Head of Prepaid for MasterCard, Scott developed MasterCard's global prepaid strategy and oversaw its global prepaid business. Scott was the founder and CEO of Solspark; SVP/General Manager of First Data Prepaid and EVP at Meta Payment Systems. Earlier in his career he was an investment banker at Donaldson, Lufkin & Jenrette. Scott was also a founding board member of the NBPCA.

Alexander Graubner-Müller

Kreditech, Founder/CEO

Alexander Graubner-Müller believes in algorithms and statistical data as the blocks for the next Industrial Revolution. Having led the techside of Kreditech as CTO for three years, he took over the CEO responsibilities in November 2015. Prior to Kreditech’s founding, Alexander cofounded and sold the predictionmarket engine PredictX. Before he managed engineering and product development at Rocket Internet. Prior to that he worked as a financial engineer together with the research team at LGT Capital Management where he developed quantitative portfolio allocation strategies. He holds a dual degree in business and econometrics from the University of St. Gallen and the Swiss Institute of Technology.

Paul Gu

Upstart, Co-Founder

Paul is co-founder and head of product at Upstart. Paul pioneered Upstart's statistical models to predict income and employment, and now oversees the team's product and data science efforts. Paul's background is in quantitative finance - he began to profitably trade at the age of 20, and previously worked in risk analysis at the D.E. Shaw Group. He has been recognized as one of Peter Thiel's 20 under 20 Fellows and Silicon Valley Business Journal's 40 under 40. Paul studied economics and computer science at Yale University.

James Gutierrez

Insikt, CEO & Co-Founder (Oportun, Founder)

James is a leading social entrepreneur and innovator in financial technology.

In 2005, James founded Oportun (formerly Progreso Financiero), the leading provider of micro-loans to US Hispanics that recently surpassed $1.5 billion in loans and over 500,000 borrowers. As CEO from 2005-2012, James led Oportun from its development as a nascent start-up to a market leader and raised over $250 million of debt and equity. Under James’ leadership, the company scaled annual loan originations to over 200,000 with revenues of $65 million, 85 stores in California and Texas, and 600 employees.

James served on the Fed’s Consumer Advisory Council and Centennial Advisory Committee, and also architected three federal and state laws to increase the availability of affordable small dollar loans. James was also an early investor in Trulia, StubHub, OnDeck Capital, and Icon Aircraft.

James graduated with a BA in Economics from Yale and MBA from Stanford’s Graduate School of Business.

Margaret J. Hartigan

Marstone, Founder and CEO

Inspired to create an investment platform to help demystify finance for investors and enable institutions to better engage and retain clients, Margaret founded Marstone, a digital wealth platform available for white-label to existing financial institutions. For retail investors, the Marstone platform puts users at ease with their financial lives by offering holistic account analysis, personalized portfolio creation, and unparalleled user experience. For institutions, the Marstone platform augments client acquisition, enhances asset retention and improves operational productivity while avoiding disintermediating the advisor or institution from the client relationship.

Prior to starting Marstone, Margaret was a top quintile financial advisor for ten years in the Global Wealth Management Group at Merrill Lynch, split between New York and San Francisco. Margaret, along with the Marstone ensemble of designers, technologists and wealth management professionals, has developed a new breed of financial tools and investment solutions that are intuitive, useful and broadly relevant. Marstone is fully integrated with Pershing, a BNY Mellon company, and is a proud IBM Business Partner.

Margaret is a graduate of Brown University, a former trustee of Sonoma Academy in Santa Rosa, California, and an active leader in the alumni and major development efforts at Brown University and Phillips Exeter Academy.

Ryota Hayashi

Finatext, CEO/Co-Founder

CEO / Co-Founder of Finatext and Nowcast, fintech startups originated from the University of Tokyo. Ryota started his career in Global Market Division at Deutsche Bank London, leading institutional sales in London and whole continental Europe. Later he joined GCI, a Singapore/Tokyo/London based hedge fund, leading Asian / Europe institutional client coverage. Ryota founded mobile financial solution startup, Finatext 2014 establishing biggest retail investment community in Japan less than 2 years, aiming to expand global market. Finatext is the first Japanese startup ever selected BBVA top 20 fintech startups. Ryota has B.S. in Economics at the University of Tokyo.

Joichi Ito

MIT Media Lab, Director

Joichi "Joi" Ito has been recognized for his work as an activist, entrepreneur, venture capitalist, and advocate of emergent democracy, privacy, and Internet freedom. As Director of the MIT Media Lab, he is currently exploring how radical new approaches to science and technology can transform society in substantial and positive ways. Soon after coming to MIT, Ito introduced mindfulness meditation training to the Media Lab.

Ito has served as both board chair and CEO of Creative Commons, and sits on the boards of Sony Corporation, Knight Foundation, the John D. and Catherine T. MacArthur Foundation, and The New York Times Company. In Japan, he is executive researcher of KEIO SFC, and he was a founder of Digital Garage, and helped establish and later became CEO of the country’s first commercial Internet service provider. He was an early investor in numerous companies, including Flickr, Six Apart, Last.fm, littleBits, Formlabs, Kickstarter, and Twitter.

Ito’s honors include TIME magazine’s "Cyber-Elite” listing in 1997 (at age 31) and selection as one of the "Global Leaders for Tomorrow" by the World Economic Forum (2001). In 2008, BusinessWeek named him one of the "25 Most Influential People on the Web." In 2011, he received the Lifetime Achievement Award from the Oxford Internet Institute. In 2013, he received an honorary D.Litt from The New School in New York City, and in 2015 an honorary Doctor of Humane Letters degree from Tufts University. In 2014, he was inducted into the SXSW Interactive Hall of Fame; also in 2014, he was one of the recipients of the Golden Plate Award from the Academy of Achievement.

Yuzo Kano

bitFlyer, Inc., CEO/Japan Blockchain Association,Chairman

Yuzo Kano co-founded bitFlyer in January 2014. bitFlyer provides various service of Bitcoin and has high level technology of Blockchain. Yuzo serves as the head of Japan Blockchain Association (JBA), and is committed to popularizing the Bitcoin and the Blockchain in Japan, Asia, and around the world.

Yuzo graduated from The University of Tokyo in 2001 with a Master of Engineering. Prior to bitFlyer, Yuzo worked as an Equities Derivatives and Convertible Bonds Trader at Goldman Sachs, focusing on market making for institutional investors as well as principal trading.

Mike Kayamori

Quoine, Co-Founder, CEO

Mike brings extensive experience in Investment, Business, Management, IT and Venture Capital for over 20 years in Japan, the United States and Asia.

Inspired by the innovative and disruptive blockchain technology and virtual currency, Mike co-founded Quoine with Mario Gomez Lozada in 2014.

Prior to Quoine, Mike was a Senior Vice President at SoftBank Group, managing its Asia / India operations, investments, and joint ventures with SingTel and Bharti Group as well as the Chief Investment Officer of Gungho Asia, the creator of Puzzle and Dragons.

Before joining SoftBank, Mike was a Senior Director at Globespan Capital Partners, an independent Venture Capital with over USD1.2B under management, with responsibilities in Japan Investment as well as Asia business development.

Prior to Globespan, Mike worked at Mitsubishi Corporation’s New Business Initiative Group and established Natural Lawson as well as the joint venture with Boots to create Boots MC.

Mike graduated from The University of Tokyo and Harvard Business School.

Leanne Kemp

Everledger, Founder & CEO

Leanne Kemp is the founder & CEO of Everledger - a digital, global ledger that tracks and protects items of value.

With a wealth of successful startup companies under her belt, Leanne is pushing boundaries in protecting the global market of diamonds and luxury goods.

Using her extensive background in emerging technologies, business, jewellery and insurance - Leanne and Everledger are working towards ensuring global transparency by constructing a digitally encrypted certification system that assists in the reduction of fraud, black markets and trafficking.

Everledger is leading the market in real world application of blockchain boasting an impressive set of industry awards including the Meffy Award 2015 for Innovation in FinTech, BBVA Open Talent 2015, FinTech Finals 2016 for Best in Show and European Financial Tech Awards 2016 for Best Blockchain Company.

Michael Kent

Azimo, Founder and CEO

Michael Kent is a serial entrepreneur, who has spent the last decade building businesses in consumer financial services.

He founded Small World Financial Services Group in2004, growing the multi billion-dollar company to become Europe’s largest offline money transfer provider and a top ten player globally.

Recognising the impact mobile and social technology could have on the international money transfer market, Michael started Azimo to challenge high-transfer costs and drastically speed-up the way consumers send money abroad. Backed by over $30m in funding, the platform now enables anyone to send cash, bank transfers and mobile money to over 190 countries, in 70+ different currencies and over social media platforms such as Facebook.

Alongside Azimo, Michael founds and invests in consumer-focused banks and financial services businesses (e.g. CorporatePay, Curve, YoYo Wallet, ClarityFX) and advises institutional investors and blue-chip corporates on cross-border payments. He previously held senior M&A positions at WPP and News Corp.

Michael holds a MA from Cambridge University and a MBA from INSEAD.

Satyen V Kothari

Cube, Founder, CEO

Satyen is the founder of Cube, an award winning mobile banking service for the Indian millennial.

His prior experiences include founding Citrus Payments, where he led overall strategy, product, user experience, marketing, and strategic alliances to drive the company to a $100 million plus organization in 4 years. He has spent 15 years in the Silicon Valley establishing companies in the areas of marketing automation, social e-commerce, and strategy/design consulting. He loves questioning the status quo, and to push the boundaries of accepted thinking, whether it comes to solutions, business, design and social practices.

His career has included stints with both start-ups and large companies such as Intuit, First Data, Cisco, AOL, Yahoo, frog Design & Apple. This has involved being an entrepreneur, a consultant, and an educator in start-ups, Fortune 500 companies, incubators, and educational institutes in the United States, Europe, and Asia.

He is also an angel investor in India and has invested in 6 companies in the spaces of marketplaces, payments, solar, and education. He is an active member of the Stanford Alumni Association of India and Stanford Angels. He also serves on advisory boards of 2 incubators – Zone Startups (a Bombay Stock Exchange and Ryerson collaboration) and Venture Studio (a Stanford University and Amdavad University collaboration).

He finished a Masters from Stanford University in tech entrepreneurship/HCI/Computer Science in 1996, and a BE in Computer Science/Engineering from Bombay University in 1995. He is an aspiring kite-surfer, alternative travel fan, and a roving philosopher in his spare time.

Jorn Lambert

Mastercard, Executive Vice-President, Digital Payments & Labs – Channels and Regions

Jorn Lambert is Executive Vice‐President, Channels and Regions in Digital Payments & Labs. In this role, he is responsible for the relationships with Digital Participants (MasterCard partners in the digital space, including Operating Systems, device manufacturers, telcos, merchant enablers, wallet operators and social networks) as well as the regional teams who deploy MasterCard’s Emerging Payment products across the world. Previously, he was responsible for the management and development of Emerging Payment Products for European markets, including e‐commerce, mobile commerce, person‐to‐person payments, contactless payments and inControl.

Mr. Lambert joined MasterCard in September of 2002, managing Core Products for MasterCard Europe, including consumer credit, commercial cards, debit and prepaid.

Prior to joining MasterCard, Mr. Lambert spent many years in the capital markets where he occupied various management positions in the areas of product development, product management and corporate strategy.

Mr. Lambert has a degree in Roman Philology at the University of Ghent and La Sapienza in Rome, Italy, and a post‐graduate degree in business economics from the University of Leuven in Leuven, Belgium.

Michael Laven

Currencycloud, CEO

Michael Laven is the CEO of Currencycloud, a rapidly-growing FinTech company that is transforming how businesses move money around the world. Currencycloud is well positioned to bring long-awaited change to the international payments landscape, by exchanging and transferring money as a cloud-based service. Joining in 2012, Mike is the driving force behind the firm, growing it to $10bn in international payments.

An accomplished entrepreneur, Mike is highly skilled at building and leading venture-backed FinTech companies towards profitable growth. Over the past two decades, he has held leadership roles with a number of FinTech firms in London and Silicon Valley, including Infinity Financial Technology, Cohera and Coronet, FRS Global and Traiana.

Behind Mike’s easy-going personality lies one of the sharpest minds in the financial technology industry. Mike has a BA from Wesleyan University and advanced degrees from Harvard and the School for International Training.

John McDonnell

Uphold Merchant Services, CEO

John is CEO of Uphold Merchant Services (UMS), a global payment services provider that utilizes Uphold’s cloud-based financial technology platform as its foundation. John joined UMS through Uphold's acquisition of Bitnet Technologies, a payment processing platform for digital currencies which John co-founded and led as CEO. Prior to Bitnet, John held executive roles at Visa, CyberSource (Nasdaq:CYBS, acquired by Visa), Paymo (now BOKU), PaylinX (acquired by CyberSource), and Transaction Network Services (NYSE:TNS). John is also an active private investor with extensive board experience and practiced securities law earlier in his career. John earned his B.A. degree with honors from Stanford University and his J.D. from UCLA law school.

Jose Garcia Moreno-Torres

Kreditech, CDO

Jose Garcia Moreno-Torres, CDO at Kreditech holds a PhD in Artificial Intelligence and has been an invaluable member of the Kreditech team since April 2013. He is responsible for the Data Science department focusing on credit scoring and customer lifetime value optimization and yield management. Jose oversees all data-driven modelling and automated decision making. When given enough data, he can see into the future!

Yukio Noguchi

Economist/Waseda Universiry, Adviser of the Cernter of Finance Research / Professor Emeritus at Hitotsubashi University

Yukio Noguchi is an expert in Finance Theory and Japanese Economic Theory. He graduated from The University of Tokyo, Faculty of Engineering, and joined the Ministry of Finance in 1964. In 1972, he received his Ph.D. in Economics from Yale University. He served as a Professor at Hitotsubashi University, Director of the Research Center for Advanced Science and Technology at The University of Tokyo, Visiting Associate Professor of Stanford University, as well as Professor of the Graduate School of Finance, Accounting and Law at Waseda University. He has a deep interest in BitCoin and published “Innovation of Virtual Currency” Diamond, Inc. (2014).

His major publications in Japanese include “Japanese Economy collapsed by Monetary Easing Policy” DIAMOND, Inc. (2013), “Fictional Abenomics” DIAMOND, Inc. (2013) and others.

Katsuaki Sato

Metaps, Inc., CEO & Founder

Sato is the Founder and CEO of Metaps, which he started in 2007 while still enrolled at Waseda University. In 2011, he launched the data-driven app monetization platform “Metaps” and lead the expansion of Metaps to 8 locations worldwide. In 2013, Sato launched the online payment platform “SPIKE”. He was awarded “THE START-UP OF THE YEAR 2015” by Forbes, and selected as one of the “Top 100 Global Players in Japan” by AERA, also in 2015. Sato is the author of “How to predict the Future”and “The Three Things You Want to Know to Be Successful in the Global Smartphone Market”.

Norio Sato

FSA, Director, Planning Division, Planning and Coordination Bureau

After graduating from the University of Tokyo’s Faculty of Law in 1989, Sato joined the ex-Ministry of Finance and was appointed to departments related to financial investment, budgets, securities and banking. He was the First Secretary of the Japanese delegation to the OECD (in charge of finance and corporate governance) between 2001 and 2004. From 2005 he joined the Cabinet Legislation Bureau for a period of 5 years, during which time he was in charge of reviewing Public Finance and Finance Law. In 2011 he was appointed Director of the Research Office, Director for Credit System, and Director of the Planning Division. He was recently in charge of framing the Amendments to the Banking Act of Japan, approved by the National Diet this year.

Shaun Port

Nutmeg, CIO

Shaun has over 25 years’ experience developing and implementing multi-asset investment strategies for clients ranging from central banks to pension schemes to charities and high-net worth private individuals. He joined Nutmeg in September 2012 and is responsible for all aspects of the investment proposition.

He was previously at BDO Investment Management, where he was Chief Investment Officer for six years, in charge of the investment proposition for high-net worth and ultra-high net worth clients. While at BDO, he designed and managed a range of award-winning funds across multi-asset portfolios, commodities and fixed income. Prior to BDO, he was Senior Economist and Head of Research for Crown Agents Investment Management, part of the team managing global bond and equity portfolios for central banks, sovereign wealth funds and public sector pension schemes. Shaun holds a degree in Mathematical Economics from the University of Birmingham, is a Chartered Alternative Investment Analyst and an accomplished communicator, including regular appearances on BBC television and radio, Sky News, Bloomberg and CNBC.

Ling Tang

Tencent, Assistant GM of Strategy Development

Ling Tang joined Tencent’s Strategy Development Department since 2014 and take a lead at Tencent’s Internet Finance business and initiatives. Before joining Tencent, Ling was a financial analyst in BNP Paribas’ Equity Research department, covering China and Taiwan insurers and banks. Before that, Ling spent 3 years at McKinsey, helping financial institutions develop business strategies, improve operational efficiency, and establish sales force management mechanisms.

Tom Theobald

Luxembourg For Finance, Deputy CEO

Tom Theobald is the Deputy CEO of Luxembourg for Finance (LFF), a public-private partnership between the government and the financial services industry in Luxembourg. In his role as Deputy CEO, Tom assists the agency in its strategic mission to develop the Luxembourg financial centre and promote its expertise and diversity abroad. Tom Theobald previously worked as Adviser at the Luxembourg Bankers’ Association (ABBL), where he was in charge of Communication and Press relations. He also held the position of Secretary of the ABBL Board of Directors. Prior to joining the ABBL in 2008, he served as an attaché to the Permanent Mission of Luxembourg to the United Nations in New York. Tom holds a PhD in English Literature from the University of Newcastle-upon-Tyne.

Daniel Tu

Ping An Group, Group Chief Innovation Officer

Daniel joined Ping An Group in April, 2013. Ping An is an integrated financial services group in China with core business in insurance, banking, and investments. Ping An is also China’s largest non-SOE. As Group Chief Innovation Officer, Daniel is responsible for initiating and creating internal innovation projects with its 27 subsidiary companies and collaborates closely with Ping An Technology. He and his team are also responsible for forging strategic partnerships and identifying new business opportunities for PA companies including the newly-created online business entities. Daniel also oversees Ping An Ventures for both domestic and overseas investments.

Daniel has nearly 30 years of experience including sales and marketing, PR, media, business development, and related executive leadership positions mostly in Asia and specifically, in the Greater China market. His focus in the last 10 years has been investing in technology and innovation areas. He previously served on the Board of Taiwan National Lottery, and Advisory Boards of Visa Products Group, Asia, and Sina.com. He currently serves on the Advisory Committee of Microsoft’s Innovation Outreach Program (IOP).

Vladyslav Yatsenko

Revolut, CTO

Vladyslav is the co-founder & CTO of Revolut, an award winning and one of the fastest growing fintech businesses in Europe that has acquired over 300k users since launch in July 2015. Before Revolut Vladyslav built trade processing and risk management software for Tier 1 investment banks, inter alia, Credit Suisse, Deutsche Bank and UBS. He also has experience in bespoke and out-of-the-box airline booking systems and telecom BSS systems.

Vladyslav holds a Masters degree in Computer Science. He is an entrepreneurial technologist with a particular interest in exponential technology and distributed systems.

Koichiro Wada

ResuPress, Inc.,CEO/Japan Blockchain Association,Manager

Born in 1990. Admitted to the Tokyo Institute of Technology in 2009, and won the Cookpad Hackathon as a third year student. During this time, he also developed the Android job search app “SPI Training”, which achieved 100,000 downloads. In 2014 Wada was appointed CEO of ResuPress Inc, which established both STORYS.JP which gave birth to the movie “Flying Colors” that generated 20 billion yen in box office revenue, and the entire Coincheck system. In 2016 Wada was selected as one of Japan’s top 50 innovators. He is also a supervisor/ an auditor of the Japan Blockchain Association (JBA).

Hiroshi Mikitani

Rakuten, Inc., Chairman and CEO

Hiroshi Mikitani is Chairman and CEO of Rakuten, Inc., one of the world's leading e-commerce companies. He has been referred to as a maverick in his approach and is widely seen as the leader of an emerging, 'New Japan', one which increasingly turns away from traditional modes of doing business.

Born in Kobe, Japan, he graduated from Hitotsubashi University in 1988, and earned his MBA from Harvard Business School in 1993. Personal tragedy in the 1995 Great Hanshin earthquake inspired him to leave a promising career in investment banking to create something that he thought would be more meaningful to society. Starting out with just a handful of team members, he launched the "Rakuten Ichiba" marketplace in May 1997. Today, Rakuten is the world’s third largest e-commerce company by revenue and is listed on the First Section of the Tokyo Stock Exchange.

Koichiro Isami

Rakuten Card Co.,Ltd, Executive Officer/Dept. Manager, Business Loan Promotion Department

Joined Rakuten Card in 2015. Making the most of his extensive experience in product development and credit administration in corporate finance, Isami developed, in October 2015, Rakuten Super Business Loan Express, a new SME finance product that utilizes big data owned by Rakuten Ichiba and targeted at stores doing business through Rakuten Ichiba. Isami is currently Rakuten’s Business Loans Promotion Management Manager.

Nobuhiko Masaki

Rakuten Securities, Inc., Department Manager, Investment Management Business Unit, Asset Solution Division

Nobuhiko “Nobu” Masaki joined Rakuten Securities, Inc. in 2015 as Department Manager of Investment Management Business Unit. With his leadership, Rakuten has successfully launched its first FinTech service “Raku-wrap” in July 2016.

Nobu has an extensive career in financial field especially in sales and planning and development of financial products for both retail and institutional customers. Before assuming his current position in 2015, he had worked for several asset management companies and securities companies including Mitsubishi UFJ Kokusai Asset Management Co., Ltd., Blackrock Japan Co., Ltd., Mizuho Securities Co., Ltd., T&D Asset Management Co., Ltd., and Invesco Asset Management (Japan) Limited.

Nobu also founded IFIS Co., Ltd in 1996 which provides an investment trust performance analysis tool. The company was sold to S&P Global Ratings in 1999. Nobu graduated from Sophia University in 1989.

Masaya Mori

Rakuten, Inc. Executive Officer / Global Head, Rakuten Institute of Technology / Japan Institute of Information Technology, Secretary

Joined Rakuten Inc in 2006 after working at Accenture. In his current positions of Rakuten Executive Director and Global Head of Rakuten Institute of Technology, Mori is in charge of five institutes around the world, integrating research and development. Advisory board member of the Information Processing Society of Japan, Director of the Database Society of Japan, Executive Member of Nikkei IT Innovators, and Executive Member of the Japan Institute of Information Technology. In 2013 Mori was selected as one of “40 Prodigies” by the Nikkei Sangyo Shimbun newspaper. He has authored books including Kuraudo Daizen [The Complete Cloud Computing] (co-authored, Nikkei BP) and Webu daihenka, pawaa shifuto no hajimari [massive change in the web – the start of a power shift] (Kindai-Sales Co).

Stephen McNamara

Rakuten Blockchain Lab, CTO

Stephen McNamara is a highly experienced CTO and entrepreneur with over 25 years in the design, implementation, and deployment of scalable software systems; primarily in FinTech and distributed systems. He has worked on many complex products covering medical informatics, middleware and messaging protocols, very large test automation (think millions of tests) and payments (3 times).

Most recently as CTO & co-founder of Bitnet, McNamara led the product and technology teams in building the worlds' best in class digital currency processing platform. He was heavily involved in all aspects of the business; from corporate formation and team development, to product delivery, strategy, fund raising, IR and customer growth. Now as CTO of the newly created Rakuten Blockchain lab, McNamara sees the potential that the blockchain has for a profound positive impact on Rakuten’s many businesses.

Previously as CTO for Visa/CyberSource, he was responsible for all aspects of technology vision, strategy and architecture.

Moderators

Takashi Hara

Nikkei Business Publications, Chief Editor of Nikkei FinTech

Born in Miyazaki Prefecture, Hara graduated from the Department of Political Science and Economics, the School of Political Science and Economics, Waseda University. In 2000 he joined Nikkei Business Publications, Inc. where he worked as a Nikkei PC journalist specializing in telecommunications, where he reported on local governments’ transition to IT. In 2006 he launched the Nikkei PC website “PC Online”, and in 2007 founded Nikkei NETMarketing (currently Nikkei Digital Marketing). Since 2010, Hara has been covering, in his role as a Nikkei Business journalist, the IT and distribution industries. In January 2016 he was appointed the Founding Editor-in-Chief of “Nikkei Fintech”, the only specialist FinTech magazine in Japan.

Sumant Mandal

March Capital, Partner

Sumant is a co-founder and Managing Director at March Capital Partners, a multi-stage technology fund; and a Managing Director at Clearstone Venture Partners. He is also a co-founder of The Hive, an AI & Big data focused incubator; and The Fabric, a cloud and networking focused incubator.

He has incubated over twenty projects in his career, and led investments in numerous technology companies. He has seen many successful exits in multiple geographies of the world. His passion lies in helping entrepreneurs realize their vision of serving the next billion people coming online, investing behind the increasing world of globally connected devices and “things”, and supporting applications to utilize big data to make more intelligent decisions and create radical efficiencies. His recent investments echo those themes.

He has supported and invested in numerous companies’ attainment of market dominance, including The Rubicon Project (NYSE:RUBI), the world’s largest display advertising company; and BillDesk, India’s largest electronic payments company. Other investments include Kazeon Systems (acquired by EMC), Mimosa Systems (acquired by Iron Mountain), Ankeena Networks (acquired by Juniper), Cetas (acquired by VMware), Apture (acquired by Google), Kosei (acquired by Pinterest) and Deep Forest Media (acquired by Rakuten).

Sumant is on the board of The Rubicon Project (NYSE:RUBI), E8 Security, Perspica, Coho Data, Velocloud, Foghorn, Pensa, Clearfly Networks, Games2win (India), BillDesk (India) and CarTrade (India).

He holds a Masters of Business Administration from Northwestern University, Kellogg School of Management and Bachelors of Science from Michigan State University. He is a charter member at TiE.

Masakazu Masujima

Mori Hamada & Matsumoto, Partner, Attorney at Law admitted in Japan and New York

Masakazu (Masa) Masujima is a partner at Mori Hamada & Matsumoto.

Masa represents various financial institutions through fund creation, private equity financing and acquisition financing as well as variety of M&A transactions involving financial institutions. In addition, Masa represents venture capital firms and help them form partnership funds and undertake venture financing. He also worked at Financial Services Agency of Japan from 2010 to 2012 as legal and compliance group head of Insurance Business Division and deputy director at Banks Division I.

Before joining FSA, Masa worked at Silicon Valley law firm of Wilson Sonsini Goodrich & Rosati in 2006 and 2007.

He is a member of the Ministry of Economy, Trade and Industry’s Blockchain Investigation Committee and a member of the Sharing Economy Investigation Committee of the Cabinet Office’s Comprehensive IT Strategy Investigation Office.

His recent publications include “Laws on FinTech” (Nikkei BP, 2016) and “Blockchain Technology and Changes in Banking Operations” (Regional Banks Association Monthly Report, 2016)

Masa is admitted to the Bar in Japan and State Bar of New York. He holds LL.M in Columbia Law School and LL.B in University of Tokyo.

Bundeep Singh Rangar

Rangar Capital Management, Managing Partner

Bundeep Singh Rangar is a recognized tech entrepreneur with more than 21 years' experience in financial services, technology and media. He has invested in, advised or incubated a number of companies in the UK, Canada and India.

He holds founding CEO roles in PremFina, a UK provider of finance to enable the purchase of insurance premiums; in IXL Holdings, a European company that has facilitated more than $300 million in bank financing to UK companies involved in consumer and SME lending; in Fineqia, a crowd funding company focussed on debt securities; and in IndusView, a London-based India focused advisory firm.

He has been a senior advisor to high-growth start-ups such as Skype, and multinationals such as India's largest IT services co. Tata Consultancy Services, the world's No.2 mobile operator T-Mobile (UK), U.K.'s top telecom BT and Europe's top carmaker Volkswagen.

He has also advised the U.K.'s largest specialist recruitment co. Hays, biggest residential property lettings firm Grainger Trust; top credit scoring co. Experian; largest software co. Sage; top financial information providers Bloomberg and Reuters and Denmark’s online investment banking platform Saxo Bank, on growth opportunities in India.

He was previously Managing Director of Technology Markets (Europe) at NASDAQ's largest market maker Knight Securities. Earlier, Bundeep created the first index of European Internet stocks at Bloomberg, where he also hosted Europe's first daily live TV show on the Internet and technology.

Bundeep frequently provides commentary on the latest in the world of tech and finance for the BBC, CNBC, CNN and Sky News. He has been profiled in magazines such as the Red Herring and India's Business Today. He publishes a blog at www.rangar.com and video blog at www.rangar.tv.

He takes an active interest in issues related to technology-led innovation, fintech, world economics and human rights. He is also an Ambassador of Sporting Equals, a UK institution promoting ethnic diversity across sports activities.

Bundeep holds a MSJ degree from Columbia University, New York; a BA from McGill University, Montreal; a Diploma in Internet and Advertising from the University of California, Berkley; a Diploma in International Relations from the University of Vienna, Austria; and a Diplôme d' Études Collégiales in Commerce and Pure and Applied Science from Marianopolis College, Montreal. In India, he studied at the Lawrence School, Sanawar.

Kenji Saito

BlockchainHub Inc., CSO

The Chief Science Officer at BlockchainHub Inc. A researcher of Internet and Society. He received his M.Eng in Computer Science from Cornell University in 1993. He has been a resident of Shonan Fujisawa Campus (SFC), Keio University, since 2000, where he received his Ph.D. in Media and Governance in 2006. He has been a senior researcher of Keio Research Institute at SFC since 2014, after serving as a project senior assistant professor there.

Waichi Sekiguchi

Nikkei Inc, Editorial Board Member and Nikkei Asian Review Editorial Board Member

Born in Saitama Prefecture in 1959, graduating from Hitotsubashi University’s Faculty of Law in 1982, after which he joined Nikkei Inc.

Harvard University Fulbright Scholar from 1988 to 1989.

Chief writer for the English-language Nikkei from 1989 to 1990, then correspondent for the Nikkei’s Washington bureau from 1990 to 1994.

Chief writer in charge of electronics in the Industry Department, then appointed editorial committee member in 1996. In 2000 Sekiguchi was appointed editorialist, and for the next 15 years was in charge of writing the telecommunications sector editorial.

Appointed visiting professor of Hosei University Graduate School in 2006, visiting professor of GLOCOM (Center for Global Communications) in 2008, and since 2015 has also been a visiting professor of the University of Tokyo Graduate School.

Sekiguchi is also a part-time lecturer at Waseda University and Meiji University.

Sekiguchi was also a commentator for NHK World’s “Nikkei Japan Report” from 2009 to 2012, and newscaster for BS Japan’s “NIKKEI×BS Live 7PM” from 2012 to 2013.

Written works include Pasocon kakumei no kishutachi [standard bearers of the PC revolution] (Nikkei Inc) and Jouhou tansaku jutsu [information search skills] (Nikkei Inc ) while he has co-authored Mirai o tsukuru jouhou tsuushin seisaku [telecommunications policies for the future] (NTT Publishing) and Nihon no mirai ni tsuite hanasou [Let’s talk about the future of Japan] (Shogakukan).

Ryushi Watanabe

Thomson Reuters, Head of Market Development-Japan

Ryushi Watanabe is the head of business strategy at Thomson Reuters in Japan. He leads the team of specialists, covering from financial services to GRC (governance, risk, and compliance), leveraging the latest technology available.

Thomson Reuters is actively engaged in “Innovation in Finance”at the World Economic Forum, collaborating with various FinTech ventures through its open-platform business solutions. The company hosts FinTech Ecosystem Study Group in Japan.

Prior to joining the company in 2014, Ryushi spent 18yrs at the investment bank Nomura, where he was the Managing Director for Global Markets business.

Takuya Kitagawa

Rakuten, Inc. Executive Officer/Director, Data Intelligence Supervisory Dept.

After studying mathematics and physics at Harvard University, Takuya Kitagawa obtained his Ph.,D. from the Harvard University Department of Physics. Before joining Rakuten, he was a theoretical physicist with more than 15 publications in refereed journals such as Science.

He currently leads data science and big data initiatives for Rakuten with the aim of accelerating data utilization throughout the whole group. Together with Rakuten Ichiba’s merchants, he is directing service improvements to provide the best possible user experiences through his scientific understanding of customers.

Oskar Mielczarek de la Miel

Rakuten FinTech Fund,

Managing Partner and Executive Officer

Oskar Mielczarek de la Miel manages the Rakuten Fintech Fund, working with financial technology start-ups in North America, Europe and Asia, and in close cooperation with Rakuten’s various financial services units. Oskar has extensive experience in the financial industry, covering investment banking and capital markets while at JP Morgan, private equity and retail financial services in North America and Europe.

Rakuten Fintech Fund’s investments include WePay, a payments provider for online marketplaces, Currencycloud, a next-generation payments engine, Insikt, a white label loan origination and investing platform, BlueVine, an online factoring solution, Acorns, a millenial robo-advisory platform, Azimo, a global remittance disrupter, and Bitnet, a blockchain company.

In addition, Oskar has led opportunistic investments in the sharing economy, including Cabify, a car riding app operating in Spain and Latin America.

Oskar earned his MBA at Harvard Business School and his BA at ICADE in Spain.

Fernando Paulo

Rakuten, Inc., Executive Officer/General Manager, Ecosystem Services Dept.

Fernando Paulo is an Executive Officer at Rakuten.

He currently leads a global organization responsible for Rakuten's ecosystem technologies such as Identity and Loyalty platforms, Payment Gateways, Mobile, Geolocation services and others.

Before Rakuten, Fernando worked at GREE International as a VP of Engineering. Prior to that, he spent 12 years at Yahoo leading multiple organizations and building large scale Internet services.

He holds a BSc in Computing and Information Systems from the University of London and an MBA from the Massachusetts Institute of Technology (MIT).

* Please note that the program, including the speakers, may change without notice.

PROGRAM

9:35

9:40

10:00

FinTech creating new Economy in Japan

Takatoshi ItoProfessor, School of International and Public Affairs, Columbia University/Senior Professor, National Graduate Institute for Policy Studies (GRIPS)

Technology Evolutions

Stephen McNamaraRakuten Blockchain Lab, CTO

Vladyslav YatsenkoRevolut, CTO

Moderator: Fernando PauloRakuten, Inc., Executive Officer/General Manager, Ecosystem Services Dept.

It has been pointed out that Japan lagged in adoption of FinTech. However, as many FinTech start-ups have emerged; and due to the establishment of supporting team as well as establishment of regulations by authorities in Japan, finally FinTech starts to kick off. Promoting the new employment and growth opportunities as well as deregulation is critical issues for the Japan economy Meanwhile new growth in the financial sector, which occupies an important part of the economy, is greatly expected to help stimulate the economy. What new will FinTech bring to Japan Economy.

In FinTech, innovative services are born only after the invention of Technology. How future Technology can evolve and where will it go?

10:40

Innovation in FinTech

Freddy DominguezComparaGuru.com, Co-Founder

Alain FalysYoyo Wallet, Co-Founder and CEO

Margaret J. HartiganMarstone, Founder&CEO

Leanne KempEverledger, Founder & CEO

Moderator: Oskar Mielczarek de la MielRakuten FinTech Fund, Managing Partner and Executive Officer

The latest couple of years have seen the overnight emergence of fascinating start-ups that have shaped up the financial services scene – and the establishment of a new industry: FinTech. How meaningful is the innovation? How impactful are the disruptors? Can existing and new players co-exist?

Tencent, which has outstanding market share in Chinese SMS, expands the financial services business, and provides innovative services with the harmony of Internet and Finance. What is a new image of financial service in Internet ecosystem which Tencent is looking for?

11:20

Can Robo Advisory change the world of asset management?

Eli BrovermanBetterment, President and Co-Founder

Walter CruttendenAcorns, Co-Founder & Chairman

Nobuhiko MasakiRakuten Securities, Inc., Department Manager, Investment Management Business Unit, Asset Solution Division

Shaun Port Nutmeg, CIO

Moderator: Ryushi Watanabe Thomson Reuters, Head of Market Development-Japan

Asian Fintech Innovations

Ryota HayashiFinatext, CEO/Co-Founder

Satyen V KothariCube, Founder, CEO

Daniel TuPing An Group, Group Chief Innovation Officer

Moderator: Sumant MandalMarch Capital, Partner

Robo advisory service that emerges in the United States is showing presence in Japan one after another. In Japan, we still cannot see the shift of mindset from saving to investing, so can Robo advisory change this trend? Also can small investment through smart devices trigger more investing willingness in young generation?

Silicon Valley, New York and London are the center and conventional hub of FinTech, while the Asian regions such as China and India gains power rapidly. Each Asian country has very unique environments. India has leapfrogging environment in infrastructure with English being widely spoken; China is very big and competitive market while Japan has solid infrastructure and developed financial system. Representative entrepreneurs from India, China and Japan will discuss the chance of Asian FinTech.

11:50

Lunch break

Lunch break

13:00

Data Based Lending – A Revolution?

Alexander Graubner-MüllerKreditech, Founder/CEO

Paul GuUpstart, Co-Founder

James GutierrezInsikt, CEO & Co-Founder (Oportun, Founder)

Koichiro IsamiRakuten Card Co.,Ltd, Executive Officer/Dept. Manager, Business Loan Promotion Department

Moderator: Oskar Mielczarek de la MielRakuten FinTech Fund, Managing Partner and Executive Officer

New era of the financial institutions under the blockchain revolutions

Nicolas CaryBlockchain.info, Co-Founder

John McDonnellUphold Merchant Services, CEO

Yukio NoguchiEconomist / Waseda University, Adviser of the Center of Finance Research / Professor Emeritus at Hitotsubashi University

Moderator: Kenji SaitoBlockchainHub Inc., CSO

Traditionally, banks have made credit decisions based on the historical financial data of borrowers. Thanks to the availability of big data, emerging players are now able to make credit decisions using multiple data points, including a customer’s social tree or e-commerce transaction data from. What type of advantages does this type of lending have versus traditional lending?

Block chain technology that has been used in the virtual currency has more power to change traditional systems of financial institutions completely. It will be applied not only in field of payment but in a lot more fields including non-financial area. How does block chain technology change the image of financial institutions and industries?

13:40

Leading in Digital

Jorn LambertMastercard, Executive Vice-President, Digital Payments & Labs – Channels and Regions

Samurai Bitcoin Players to open up new era

Yuzo KanobitFlyer, Inc., CEO/Japan Blockchain Association,Chairman

Mike KayamoriQuoine, Co-Founder, CEO

Koichiro WadaResuPress, Inc.,CEO/Japan Blockchain Association,Manager

Moderator: Takashi HaraNikkei Business Publications, Chief Editor of Nikkei FinTech

Mastercard is a technology company in the global payments space. Building on 50 years of safety and security expertise in payments, we are creating the next generation of payment technologies, merchant solutions and consumer experiences to take commerce to mobile and beyond in the 21st century.

By the latest revision of law, virtual currencies such as bit coins are defined as valuable property-like and are usable for the purchase of goods and services. And it is allowed to change virtual currencies to legal currencies such as the dollar or Japanese yen officially. On the other hand, the service providers who change virtual currency to a real currency are obliged to register with the authorities. How does the Japanese bit coin player open up the new era?

14:20

FinTech regulations: what should be regulated?

Benjamin DuranskeCCOBOX, Co-Founder, CEO

Norio SatoFSA, Director, Planning Division, Planning and Coordination Bureau

Tom TheobaldLuxembourg For Finance, Deputy CEO

Moderator: Masakazu MasujimaMori Hamada & Matsumoto, Partner, Attorney at Law admitted in Japan and New York

Money Transfer to the world- Faster, Cheaper, and Easier

Scott GalitPayoneer, CEO

Michael KentAzimo, Founder and CEO

Michael LavenCurrencycloud, CEO

Moderator: Bundeep Singh RangarRangar Capital Management, Managing Partner

In Japan, due the amendment of Banking Act and Payment Services Act, Regulations for FinTech have been in place. What are the suitable regulations for FinTech to allow new financial services?

By globalization of the economy, more money flow across the borders nowadays while bank-centric remittance system is perceived as inconvenient and costly. Can new leaders of the money transfer business break the old-fashioned custom of the banks? What can be seen beyond globalization of economy from remittance point of view ?

14:50

Break

15:10

Changing Finance, Life and Society by Big Data

Jose Garcia Moreno-TorresKreditech CDO

Masaya MoriRakuten, Inc. Executive Officer / Global Head, Rakuten Institute of Technology / Japan Institute of Information Technology, Secretary

Katsuaki SatoMetaps, Inc., CEO & Founder

Moderator: Takuya KitagawaRakuten, Inc., Executive Officer/Director, Data Intelligence Supervisory Dept.

Utilization of Big Data is the core of FinTech, and at the same time Big Data has great impact on changing our daily life and society significantly. What the coming future changed by Big Data will be like?

16:00

Wrap-up Session – FinTech Revolution changes Japan and the world

Joichi ItoMIT Media Lab, Director

Hiroshi MikitaniRakuten, Inc., Chairman & CEO

Moderator: Waichi SekiguchiNikkei Inc, Editorial Board Member and Nikkei Asian Review Editorial Board Member

FinTech will change not only financial institutions but also our daily life and society. By the impact from FinTech revolution, what will Japan and the world become?

SPONSORS

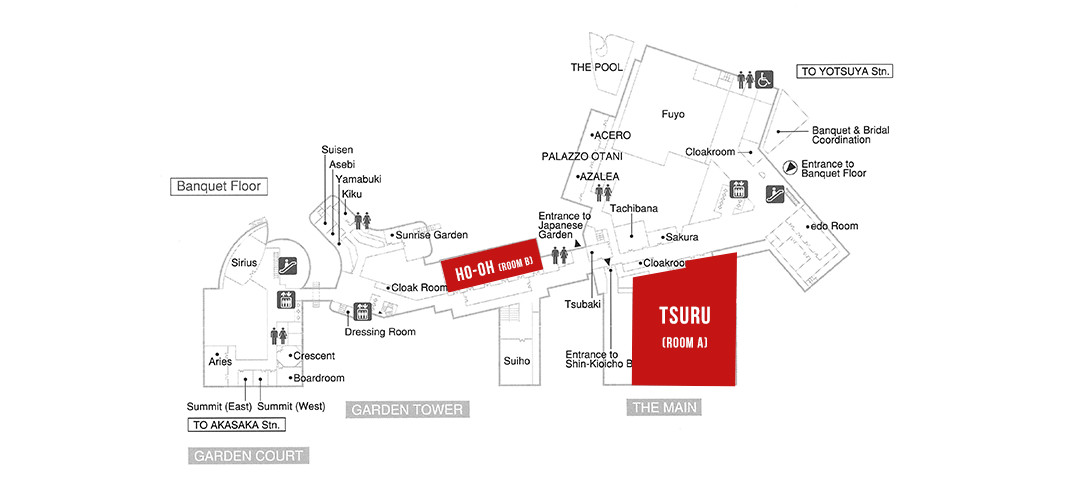

ACCESS

Hotel New Otani Tokyo

Tsuru (Room A), Ho-oh (Room B)

4-1, Kioi-cho, Chiyoda-ku, Tokyo 102-8578, JAPAN

TEL. +81-3-3265-1111

Venue Information

By Train

Akasaka-mitsuke Stn.

Subway Ginza Line

Subway Marunouchi Line

Exit D, 3 minutes

Nagatacho Stn.

Subway Hanzomon Line

Subway Nanboku Line

Exit #7, 3 minutes

Kojimachi Stn.

Subway Yurakucho Line

Exit #2, 6 minutes

Yotsuya Stn.

JR Chuo / Sobu Line

Subway Marunouchi Line

Subway Nanboku Line

Kojimachi or Akasaka Exit, 8 minutes

By Car

Kasumigaseki Exit, Shuto Expressway 10min

Tokyo Stn. 15min

Shinjuku 20min

Haneda Airport 40min

Narita International Airport 90min

From Airports

Haneda Airport

Airport Limousine (shuttle bus)

about 25 - 40 minutes

Narita International Airport

Airport Limousine (shuttle bus)

about 95 - 140 minutes

Please confirm the details on Hotel New Otani homepage.

All videos of Rakuten Fintech Conference 2016 were posted!

If you have any questions about the conference, please contact the following email address.

info-rfc2016@e-uketsuke.jp

For press inquiries, please contact the following email address.

rakuten-financialpr@mail.rakuten.com

![Rakuten FINTECH CONFERENCE 2017 2017.9.27[wed]](../img/banner_en.png)

![Rakuten FINTECH CONFERENCE 2017 2017.9.27[wed]](../img/banner_mobile_en.png)