All videos of Rakuten Fintech Conference 2017 were posted!

Opening Remarks

- Masayuki HosakaVice Chairman & Representative Director, Rakuten, Inc.

All videos of Rakuten Fintech Conference 2017 were posted!

Innovation in the fintech sector is accelerating worldwide. In Japan many financial institutions, both public and private, are exploring the benefits of applying new technologies in the financial industries and are optimistic about their impact on the Japanese economy. Gradually, the focus of attention has expanded from payment and remittance-related fields to loans and investments, and it is also becoming clear that fintech will allow major reforms in the field of insurance.

At the same time, fintech itself has evolved through consistent technical innovation, including AI and big data, as well as changes in the finance industry itself. How will fintech influence business and society and continue to change the way we live in the future? How can companies take a pioneering role in this important field and lead the next wave of fintech innovation?

At "Rakuten FinTech Conference 2017," we invite leaders in the fintech sector from Japan and overseas to share the latest trends and explore the future directions for fintech.

Professor Emeritus of Keio University, Professor of Toyo University & former Minister of State

Professor Takenaka who was born in Wakayama Prefecture in 1951 is a Professor Emeritus of Keio University and a Professor of Toyo University that holds a Ph.D. in economics. He has been a Senior Research Fellow of the Japan Center for Economic Research, President of Academyhills, the Chairman and Director of Pasona Group Inc., and an Outside Director of ORIX Corporation and SBI Holdings, Inc. He entered Junichiro Koizumi’s Cabinet as the Minister of State for Economic and Fiscal Policy in 2001, and since then, served as the Minister of State for Financial Services, Minister of State for Privatization of the Postal Services and Minister for Internal Affairs and Communications. He was elected as an Upper House Member of the National Diet of Japan in 2004; and resigned from the post and retired from politics in September 2006. He began his career at the Japan Development Bank in 1973, and after his resignation in 1981, served as a Visiting Associate Professor of Harvard University, a Professor of the Faculty of Policy Management at Keio University, etc. He received a B.A. in Economics from Hitotsubashi University.

CFO & Co-Founder, Managing Director, Simplesurance GmbH

Joachim von Bonin started his career with KPMG as auditor and consultant in Germany and Mexico. Afterwards he held various senior finance positions within the Heineken Group, ultimately as CFO of Heineken Germany. He was then appointed board member and CFO of Yoc AG, a public listed company in the area of mobile advertising based in Berlin. As Co-Founder of simplesurance he is now responsible for Human Resources, Finance, Legal and Compliance as well as Internationalization. Joachim von Bonin graduated in Economics & Computer Science in Berlin and New York and is member of the FinTech group of the Bundesverband Deutsche Startups e.V. (BVDS).

Vice President, Watson and Cloud Platform Expert & Delivery Services, IBM Watson and Cloud Platform

Toby Cappello is the Vice President of Watson and Cloud Platform WW Expert & Delivery Services. In this executive leadership role, Toby is responsible for ensuring our customers get value from our Cloud & Cognitive Platform and continue to drive adoption across the enterprise. Toby’s team is focused on guiding customers through their Cloud & Cognitive Journey and enterprise adoption through project delivery or expert assistance and enablement.

Toby has focused on working with customers to drive business value through enablement and building competencies around transformational and disruptive technologies. He and his teams have done this by aligning people, processes and technology ensuring organizations are prepared to realize near and long-term value from technology investments and business transformation.

Toby previously held Customer Engagement Executive positions with IBM's BPM business, Worksoft and Lombardi Software. Throughout Toby’s career he has been focused on customer engagement and success and sees customer value realization and positive customer sentiment as the cornerstones of a customer-facing organization.

Co-Founder & CEO, Wyre

Hailing from Sydney, Australia, Michael Dunworth now calls himself a San Francisco entrepreneur. Leveraging the power of digital currencies and blockchain technology, Mike sees the potential to disrupt the way money moves around the world. His passion is on enabling more ways for people to participate in the global financial ecosystem. Bitcoin does just that – enabling people to send money to anybody in the world, instantly and freely without the confines of the traditional banking system. Mike believes in the power of blockchain to do just that, which is why in 2016 he founded Wyre with Ioannis (Yanni) Giannaros.

When not leading Wyre, Mike likes to spend his free time giving back to the community and pursuing personal hobbies like running, chess, surfing, and video games.

Co-Founder & CEO Yoyo Wallet

Alain is the co-founder & CEO of London-based Yoyo Wallet, which provides retailers and brand with a fast and simple mobile payment solution combined with instant personalised loyalty and rewards programmes - backed by a powerful analytics and campaign platform. Yoyo is Europe’s fastest growing multi-retailer mobile wallet.

Alain is also Partner at Firestartr.co, the technology investment platform that helps startups cross the chasm to series A and beyond.

After running the commercial cards division of Visa Europe he co-founded and ran OB10, the global e-invoicing network, which floated in London as Tungsten Corporation Plc in 2013.

General Manager of the Equity Strategy Department, Investment Division,BlackRock Japan Co., Ltd.

In 1994, Ms. Iriyama joined Barclays Global Investors (BGI, currently BlackRock). She started to engage in domestic and overseas equity management at the Management Departmentin 1996 and was assigned as Domestic Equity Portfolio Managerin 1997.Even after theBGI’s management integration with BlackRock Japan in December 2009, she continued to engage in portfolio management operations at the Scientific Active Equity Management Departmentand was assigned as Strategist and Portfolio Managerof the Equity Strategy Departmentin April 2011 to take charge of product management for scientific active equity management strategies. Since July 2017, she has been head of the equity strategy divisionin Japan. Ms. Iriyama obtained a Master’s degree in Financefrom the Graduate School of International Politics, Economics and Communication of Aoyama Gakuin University.She is a Chartered Member of the Securities Analysts Association of Japan.

Chairman Asia, BitFury Group

George Kikvadze is the Chairman Asia of The BitFury Group, the world's leading Blockchain infrastructure provider and transaction processing company. He is also a member of the Advisory Committee of GCF, a $6 billion private equity partnership. Kikvadze has worked for York Capital Management, AFK Sistema and Morgan Stanley. He obtained his MBA at Wharton School, University of Pennsylvania, and his Masters at Johns Hopkins School of Advanced International Studies. Kikvadze is a member of the Europe One YPO Club.

Head of Domestic Marketing Strategy Unit, Dai-ichi Life Holdings, Inc. General Manager of Marketing Strategy Department, Dai-ichi Life Insurance Company, Limited

April 1994 Joined Dai-ichi Mutual Life Insurance Company April 2007 Appointed as Manager of Planning Department No.1 of the company

April 2010 Appointed as Manager of Management Strategy Department, Dai-ichi Life Insurance Company, Limited

April 2015 Appointed as General Manager of Marketing Strategy Department of the company

October 2016 Appointed as Head of Marketing Strategy Unit, Dai-ichi Life Holdings, Inc. (current post) and General Manager of Marketing Strategy Department, Dai-ichi Life Insurance Company, Limited (current post)

President, Mastercard Operations & Technology

Ed McLaughlin is president of Operations and Technology for Mastercard and member of the company’s Management Committee. In this role, he oversees all of Mastercard’s technology functions, including the global network, processing platforms, global technology hubs, information security and technology operations.

Prior to this role, he served as chief information officer, directing the development efforts for products and services, implementing the IT digital roadmap, and managing the development of Mastercard’s global tech hubs.

In 2010, McLaughlin was named chief emerging payments officer, leading the development and launch of the company’s digital strategy, partnerships and platforms, including Masterpass, Mastercard Send and Mastercard Digital Enablement System (MDES), the digital token program. McLaughlin joined Mastercard in 2005 as head of bill payment and healthcare, and was named chief franchise development officer in 2008, where his was responsible for the Mastercard global rules, licensing, brand standards and compliance programs.

Prior to joining Mastercard, Mr. McLaughlin was group vice president, Product and Strategy at Metavante, a financial services technology company that included supporting issuing and acquiring processing services, prepaid program management, the NYCE regional debit network, ACH processing, and other services.

Mr. McLaughlin joined Metavante in 2002 through their acquisition of Paytrust, an online payments company for which he was cofounder and CEO. Prior to co-founding Paytrust, Mr. McLaughlin was the executive vice president of product and marketing at LogicWorks, Inc., a data modeling software company.

Mr. McLaughlin is a graduate of the University of Pennsylvania, Wharton School of Business

SVP APAC CEO, PayPal

As PayPal’s Senior Vice President of Asia Pacific, Rohan Mahadevan provides strategic direction for one of the company’s fastest-growing regions covering many of the largest commerce markets in the world, including Australia, Greater China, Japan, India and Southeast Asia. Currently based in Singapore, he is responsible for increasing the company’s presence and local payment capabilities to capitalize on the explosive growth of e-commerce and m-commerce across all the markets in Asia Pacific.

His deep knowledge of PayPal’s products and capabilities drives the company vision of enabling secure payments anytime, anywhere and any way for millions of APAC consumers.

Managing Director Japan, Kraken

Kraken’s Managing Director of Japan. She joined Kraken and the cryptocurrency sector in early 2013 in San Francisco and has educated regulators and elected officials, especially after MtGox collapsed. She secured the agreement between the MtGox bankruptcy trustee and Kraken, leading the projects for the investigation and other proceedings. She is a founding member of Japan Blockchain Association and spearheads JBA’s foreign relations. She is also personally advising different cryptocurrency/blockchain projects both in the developed and the developing world, connecting the world with blockchain.

Head of Partnerships, Revolut

Rishi is Head of Partnerships at Revolut, the banking alternative for today's international consumers, which as of September has 800k customers across Europe. He focuses on developing partnerships to deliver innovative, integrated products/services for Revolut's customer base not only in Europe but also in US/Asia, where Revolut will be launching in the next few months. Previously Rishi spent 3 years taking a San Francisco based InsureTech start-up into mainland Europe on its way to an exit as an unicorn. Passionate about setting up tech driven businesses in spaces where large financial institutions have failed to serve the needs of today's customers.

Advisor for Institute for Business and Finance, Waseda University, Professor Emeritus of Hitotsubashi University

Yukio Noguchi, born in Tokyo in 1940, is an expert in Finance Theory and Japanese Economic Theory. He graduated from The University of Tokyo,Faculty of Engineering in 1963and joined the Ministry of Finance in 1964. In 1972, he received his PhDin Economics from Yale University. He served as a Professor at Hitotsubashi University, Director of the Research Center for Advanced Science and Technology at The University of Tokyo,andVisiting Associate Professor of Stanford University. He has been Professor of the Graduate School of Finance, Accounting and Law since April 2005and Advisor to the Institute of Financial Studies since April 2011at Waseda University.He is also aProfessor Emeritus at Hitotsubashi University.His major awards include: the Prime Minister’s Award in the“Papersin celebration of the Meiji Centennial”hosted by the Japanese Government in 1967;theUCLA Alumni Association Award of Distinctionin 1969; the Nikkei Prize for Economics Booksin 1974;theMainichi Economist Awardin 1979; the Suntory Prize for Social Sciences and Humanities in 1980; the Tokio Marine Kagami Memorial Foundation Awardand Japan Association for Real Estate Sciences Award in 1989; the Yoshino Sakuzo Award from Chuokoron Shinsha, Inc.in 1992; and the Softening Award from the Softnomics Centerin 1996.

CEO, PremFina

Bundeep Singh Rangar is a recognized tech entrepreneur with more than 21 years' experience in FinTech, technology and media. He has invested in, advised or incubated a number of companies in the UK, Canada and India.

He holds founding CEO roles in PremFina, a UK FinTech provider of finance to enable the purchase of insurance premiums; in IXL Holdings Limited, a European company that has facilitated more than $300 million in bank financing to UK companies involved in consumer and SME lending; in Fineqia Limited, a crowd funding company focussed on debt securities; and in IndusView UK Limited, a London-based India focused advisory firm.

He has been a senior advisor to high-growth start-ups such as Skype, and multinationals such as India's largest IT services co. Tata Consultancy Services, the world's No.2 mobile operator T-Mobile (UK), U.K.'s top telecom BT and Europe's top carmaker Volkswagen.

He has also advised the U.K.'s largest specialist recruitment co. Hays, biggest residential property lettings firm Grainger Trust; top credit scoring co. Experian; largest software co. Sage; top financial information providers Bloomberg and Reuters and Denmark’s online investment banking platform Saxo Bank, on growth opportunities in India.

He was previously Managing Director of Technology Markets (Europe) at NASDAQ's largest market maker Knight Securities. Earlier, Bundeep created the first index of European Internet stocks at Bloomberg, where he also hosted Europe's first daily live TV show on the Internet and technology.

Bundeep frequently provides commentary on the latest in the world of FinTech and finance for the BBC, CNBC, CNN and Sky News. He has been profiled in magazines such as the Red Herring and India's Business Today. He publishes a blog at www.rangar.com and video blog at www.rangar.tv.

He takes an active interest in issues related to technology-led innovation, FinTech, world economics and human rights. He is also an Ambassador of Sporting Equals, a UK institution promoting ethnic diversity across sports activities.

Bundeep holds a MSJ degree from Columbia University, New York; a BA from McGill University, Montreal; a Diploma in Internet and Advertising from the University of California, Berkley; a Diploma in International Relations from the University of Vienna, Austria; and a Diplôme d' Études Collégiales in Commerce and Pure and Applied Science from Marianopolis College, Montreal. In India, he studied at the Lawrence School, Sanawar.

Vice General Manager, Tencent

Ling Tang is a Vice General Manager in Tencent Strategy Development Department. Ling is responsible for the strategies of CaiFuTong and WeBank, across payment, wealth management, and credit business. Also, she helps evaluate other initiatives related to internet finance.

Before joining Tencent, Ling worked for BNP Paribas as research analyst on Taiwan financials and China insurance sectors. Prior to that, Ling was an Engagement Manager in McKinsey consulting, serving financial institutions in Greater China area.

Ling graduated from Indiana University with an MBA degree and National Taiwan University with Bachelor degree in accounting. Ling holds Taiwan CPA license.

Group President of Risk Solutions, Early Warning Services LLC

Eric Woodward, group president of risk solutions, leads the Early Warning risk product line. Woodward’s team is currently focused on the safety and soundness of the company’s payments network as well as its legacy authentication, identity and regulatory products. He plays a key role in the company’s acquisitions and has been instrumental in driving Early Warning’s growth strategy. Woodward is an industry veteran with more than 20 years of leadership experience in corporate finance, M&A and consulting with technology and financial services companies. Woodward joined Early Warning in 2009 to oversee Early Warning’s strategic development initiatives. Prior to joining Early Warning as an employee, Woodward served on the company’s Management Committee as a representative of Bank of America. While working as a managing director at Bank of America, he facilitated the financial institution’s initial investment into Early Warning. He also co-founded Bank of America’s Strategic Investments Group where he invested more than $1 billion in financial services-related companies. Prior to Bank of America, he led the technology investment banking group at Credit Suisse and oversaw the completion of more than $6 billion of financings and acquisitions.Woodward holds a bachelor’s degree in finance and accounting from the University of Colorado’s Leeds School of Business, an M.B.A. from the University of California Berkeley’s Haas School of Business, and a CPA license.

Professor of the Graduate School of Economics at the University of Tokyo

Professor Yanagawa served as Lecturer of the Faculty of Economics at Keio University, and joined the Graduate School of Economics at the University of Tokyo in 1996 as an Assistant Professor and Associate Professor before assuming his current position in 2011. He holds a Ph.D. in economics (The University of Tokyo). He graduated from the Faculty of Economics Distance Learning Program at Keio University in 1988 and finished his Ph.D. program of the Graduate School of Economics at the University of Tokyo in 1993.

He serves as Executive Vice President of the Nippon Institute for Research Advancement (NIRA) and Representative of Fintech Research Forum at the Center for Advanced Research in Finance (CARF), the University of Tokyo. He is also a member of Fintech research committees at the Ministry of Economy, Trade and Industry, Bank of Japan, Japan Securities Research Institute, etc.

He is an author of many books including “Economic Analysis of Laws and Corporate Activities (in Japanese), Nikkei Inc.”, “Economic Theory of Contract and Organization (in Japanese), Toyokeizai Shimposha”, “Economics of Corporate Law (in Japanese) University of Tokyo Press, with Yoshiro Miwa and Hideki Kanda co ed.”, “Japanese Growth Strategy; Mandatory Retirement at Age of 40 (in Japanese), Sakurasha”, “Working Style Independent from Companies from Age of 40 (in Japanese), Chikumashobo” and “Self-study Method Taught by Professor of University of Tokyo (in Japanese), Soshisha Publishing”.

CEO & Co-Founder, PolicyPal

Valenzia is the CEO and Founder of PolicyPal, a digital platform that uses artificial intelligence to simplify and digitise insurance for thousands of people. Former sales broker at Allianz, Valenzia feels passionately about making insurance protection simple and accessible to everyone. Upon graduation, she worked as a Risk Assurance Consultant at PwC in London. After that, Valenzia went on to become the Assistant Vice President at OCBC Bank in Singapore focusing on launching digital campaigns, working closely with wealth and marketing to drive innovations. Valenzia who was recently named to Forbes “30 Under 30” list for Finance and Venture Capital, is a post-graduate with MSc Business Management at Imperial College London and BA Digital Media at University of the Arts London. She's a frequent speaker at universities and conferences. When not at work, Valenzia is an avid globe-trotter and a sports enthusiast.

Kyash Inc. Founder & CEO

Founder & CEO of Kyash, an peer to peer payment app. The company, funded by the largest Japanese VC and financial institutions, has built the proprietary money transfer system which bypasses the conventional bank’s ACH and payment processing system which works at Visa merchants around the world.

Prior to founding Kyash, he worked as a strategic consultant at Kurt Salmon US Inc., B2C centered consulting firm after working as a banker at Japanese mega bank for establishing overseas branches and developing partnerships with foreign banks.

B.A. at Waseda University. Board member of Fintech Association Japan since 2016.

Representative Director, President, Chairman and CEO, Rakuten Inc.

Hiroshi Mikitani is the founder, chairman and CEO of Rakuten, Inc. Founded in Japan in 1997 with the mission of empowering the world through innovation, Rakuten has grown to become one of the world's leading internet services companies, ranking in the top 20 in Forbes’ annual list of The World's Most Innovative Companies every year since 2012. Born in Kobe, Mikitani was educated at Hitotsubashi University in Tokyo, began his career in investment banking, and earned his MBA at Harvard Business School. In 2011, he was appointed Chairman of the Tokyo Philharmonic Orchestra, which has the longest history and tradition of any orchestra in Japan, and serves as Representative Director of the Japan Association of New Economy (JANE).

Executive Officer & Global Head, Rakuten Institute of Technology World Wide, Rakuten, Inc. Director of Rakuten Life Tech Lab, Rakuten Life Insurance Co., Ltd. Secretary of Japan Institute of Information Technology, Japan Institute of Information Technology

Mori joined Rakuten Inc in 2006 after working at Accenture. In his current positions of Rakuten Executive Director and Global Head of Rakuten Institute of Technology, he is in charge of five institutes around the world, integrating research and development. Since July 2017, he also serves as the Director of Rakuten life Tech Lab. of Rakuten Life Insurance. He is Advisory board member of the Information Processing Society of Japan, Director of the Database Society of Japan, APEC Project Advisor, and Executive Member of the Japan Institute of Information Technology. In 2013 Mori was selected as one of “40 Prodigies” by the Nikkei Sangyo Shimbun newspaper. He has authored books including Kuraudo Daizen [The Complete Cloud Computing] (co-authored, Nikkei BP) and Webu daihenka, pawaa shifuto no hajimari [massive change in the web – the start of a power shift] (Kindai-Sales Co).

Senior Staff Writer, Nikkei Inc.

Waichi Sekiguchi is a senior staff writer for Nikkei. He joined Nikkei in 1982 and has been covering the IT industry and cyberspace issues for over 20 years. As a Washington correspondent during the Bush and Clinton Administrations in the early 90s, Sekiguchi covered US trade and government policies. He was a Fulbright fellow at the Center for International Affairs at Harvard University in the late 80s, and was a chief writer for the English edition of the Nikkei. Sekiguchi served as a news commentator for a NHK World TV program "Nikkei Japan Report" in 2009-2012. Sekiguchi graduated from Hitotsubashi University, and is currently a visiting professor at Graduate School of University of Tokyo and Hosei University Business School and the Center for Global Communications (GLOCOM) at the International University of Japan.

Executive Officer & General Manager, AI Promotion Department, Rakuten Inc.

August 2016 Rakuten, Executive Officer, General Manager, AI Promotion Department

Facilitates commercial deployment of AI features into Rakuten Services

June 2014 Rakuten, Executive Officer, Development Unit Strategy Office

Explored new domain of technology and development

2010-2014 Sony Corporation, Sr General Manager, Technology Strategy / Cloud DevOps

Developed & Operates Cloud platform and develops conversational agent technology

2003-2010 Sony Computer Entertainment Inc., CTO & EVP / SVP / Executive Officer

Developed & manages PlayStation platforms

1999-2003 Sony Computer Entertainment America, Vice President, Business & Technology

Managed PlayStation R&D team in Silicon Valley

Managing Partner, Rakuten FinTech Fund & Mobility Investments Executive Officer, Rakuten, Inc.

Oskar is the Managing Partner in charge of the FinTech Fund and Mobility Investments. He has led multiple investments in the fintech space and ride sharing, including Lyft, Cabify and Careem. Oskar serves as a board member for Cabify and Careem.

Prior to joining Rakuten, Oskar had extensive experience in the financial industry, including in investment banking and capital markets while at J.P. Morgan and Merrill Lynch, and in private equity and retail financial services in North America and Europe.

Oskar earned his BA at ICADE in Spain and MBA at Harvard Business School.

Office Manager, Technology Platform Supervisory Department Blockchain Business Development Office, Rakuten, Inc.

Ken Okamoto joined Rakuten, Inc. in 2004. After being engaged in back office operations and system development for Rakuten Ichiba, he started to promote the company’s globalization initiatives in 2008. He was posted in Brazil in 2011 and assumed the position of CEO of Rakuten Brasil Ltd. in 2014, launching payment business specialized for the country. He returned to Japan in the summer of 2016 to participate in a project to establish Rakuten Blockchain Lab in Belfast, U.K. Since last September, he has been in the current position and is promoting blockchain technologies and virtual-currency-related business within and outside Rakuten on a technological front.

Executive Officer & International Card Development Department Manager, Rakuten Card Co.,Ltd.

Ken Takano joined Rakuten in 2006. He played a major role in restructuring the credit card business and expanding the ecosystem through the credit card loyalty program in Japan. Since then, he has further expanded Rakuten’s financial services overseas by leading the formation of the co-brand credit card program in the United States and acquiring a Credit Card Banking License in Taiwan. Currently, he is developing the Rakuten Card business with international settlement as his focus. Ken earned his MBA at Georgetown University. He also serves on the Board of Directors of Rakuten Europe Bank and Rakuten Card USA.

InsurTech Promotion Department Manager, Rakuten Life Insurance Co., Ltd.

Joined Rakuten Life in 2015 after working for foreign affiliated life insurance company. Kyoko is currently InsurTech promotion department manager and a member of Rakuten Life Technology Lab which was established on July 1st. She holds a Master’s degree in International Marketing Management from Leeds University Business School (UK) after graduating from Sophia University.

As the environment surrounding the Japanese economy has dramatically changed by the inauguration of the Trump administration and international exit strategies from quantitative easing, the environment surrounding the Abe administration and Abenomics has changed, too. Professor Takenaka will deliver a speech about what the administration should do to accelerate the policy to promote innovations such as regulation reform and the special zone system and how FinTech can contribute to economic growth measures under such circumstances.

With the spread of smartphones, new ways of payments such as QR code settlement and P2P remittance are rising. What is the future of payments? In this session, Tencent of WeChat Payment in China, Early Warning Services which manages Zelle in the United States, and Kyash of Japan's startup discuss this issue.

Overview of the session about blockchain and digital currencies In this session, Yukio Noguchi, Professor Emeritus at Hitotsubashi University and panels from Bitfury, a pioneer of the mining business and Kraken, the largest virtual currency exchange in the Euro zone will discuss the bitcoin split that is the focus of interest this summer, ICO that is a method of financing by issuing a company’s own currency on blockchain like equity financing, and the fate of the Japanese market by taking into consideration these factors.

Innovation such as AI, block chain technology and sharing economy will greatly change people's daily life and society itself and open up a new future. Where is innovation and technology going? And what is the new future of finance?

With regard to Innovation of FinTech brought by AI, an academic expert and industry experts of technology & innovation, management & organization and investment & economy are invited. Experts will discuss AI’s issue, commercial use case and future.

In this session, panels from Dai-Ichi Life Insurance Co., Ltd., which is focusing on InsTech in Japan, Rakuten Life Insurance Technology Laboratory, which studies the application of cutting-edge AI technology developed through e-commerce business to life insurance, and 2 InsurTech start-ups in Asia and Europe (PolicyPal and simplesurance) will discuss InsurTech that has attracted attention in recent years and possible changes to the insurance industry brought by advanced technologies.

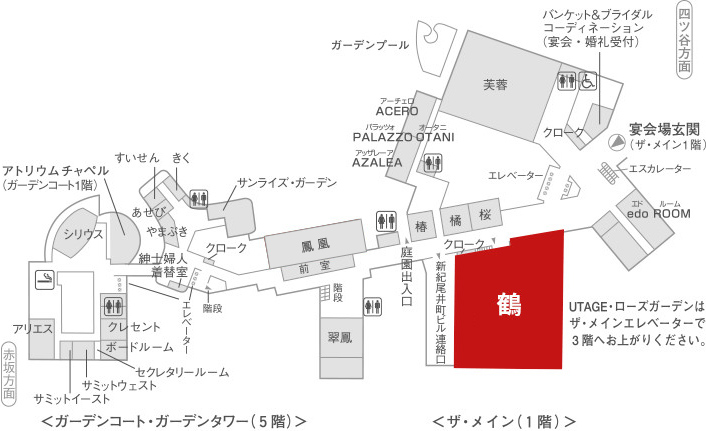

Subway Ginza Line

Subway Marunouchi Line

Exit D, 3 minutes

Subway Hanzomon Line Subway Nanboku Line

Exit #7, 3 minutes

Subway Yurakucho Line

Exit #2, 6 minutes

JJR Chuo / Sobu Line Subway Marunouchi Line Subway Nanboku Line

Kojimachi or Akasaka Exit, 8 minutes

Kasumigaseki Exit, Shuto Expressway 10min

Tokyo Stn. 15min

Shinjuku 20min

Haneda Airport 40min

Narita International Airport 90min

Airport Limousine (shuttle bus)

about 25 - 40 minutes

Airport Limousine (shuttle bus)

about 95 - 140 minutes

Please confirm the details on Hotel New Otani homepage.

All videos of Rakuten Fintech Conference 2017 were posted!

If you have any questions about the conference, please contact the following email address.

info-rfc2017@convention.co.jp

For press inquiries, please contact the following email address.

rakuten-financialpr@mail.rakuten.com